Managing taxes is often complex for both businesses and individuals, especially in ecommerce. It is even more complicated for the stores selling products in the United States where each state has a different tax rate. Native Magento systems only support tax calculation based on the Country, State and ZIP code. It's not possible to manage the tax based on the City. To address this limitation, Klizer developed the 'Tax by City' module- an advanced solution that allows retailers to apply tax rates on the city level. The module also includes API integration, allowing businesses to manage city-specific tax fields via API endpoints.

Key Scenarios Considered During the Development of the Tax by City Module :

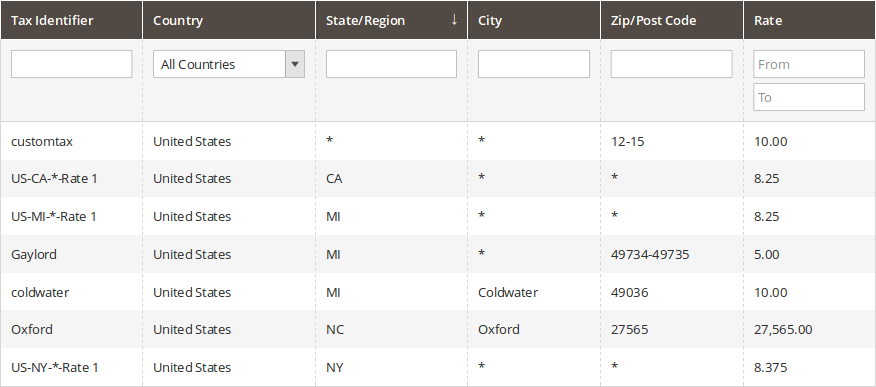

- Same City Name across different Zip codes- Tax rate may vary.

- Same Zip Code for multiple cities- Tax rate may differ.

- Single City spanning specific zip code ranges- Needs accurate mapping.

During checkout, Tax by City calculates the applicable tax based on the customer’s shipping address. The calculated tax amount is automatically added to the invoice, ensuring that the customers are well-informed about the tax breakdown..

Features

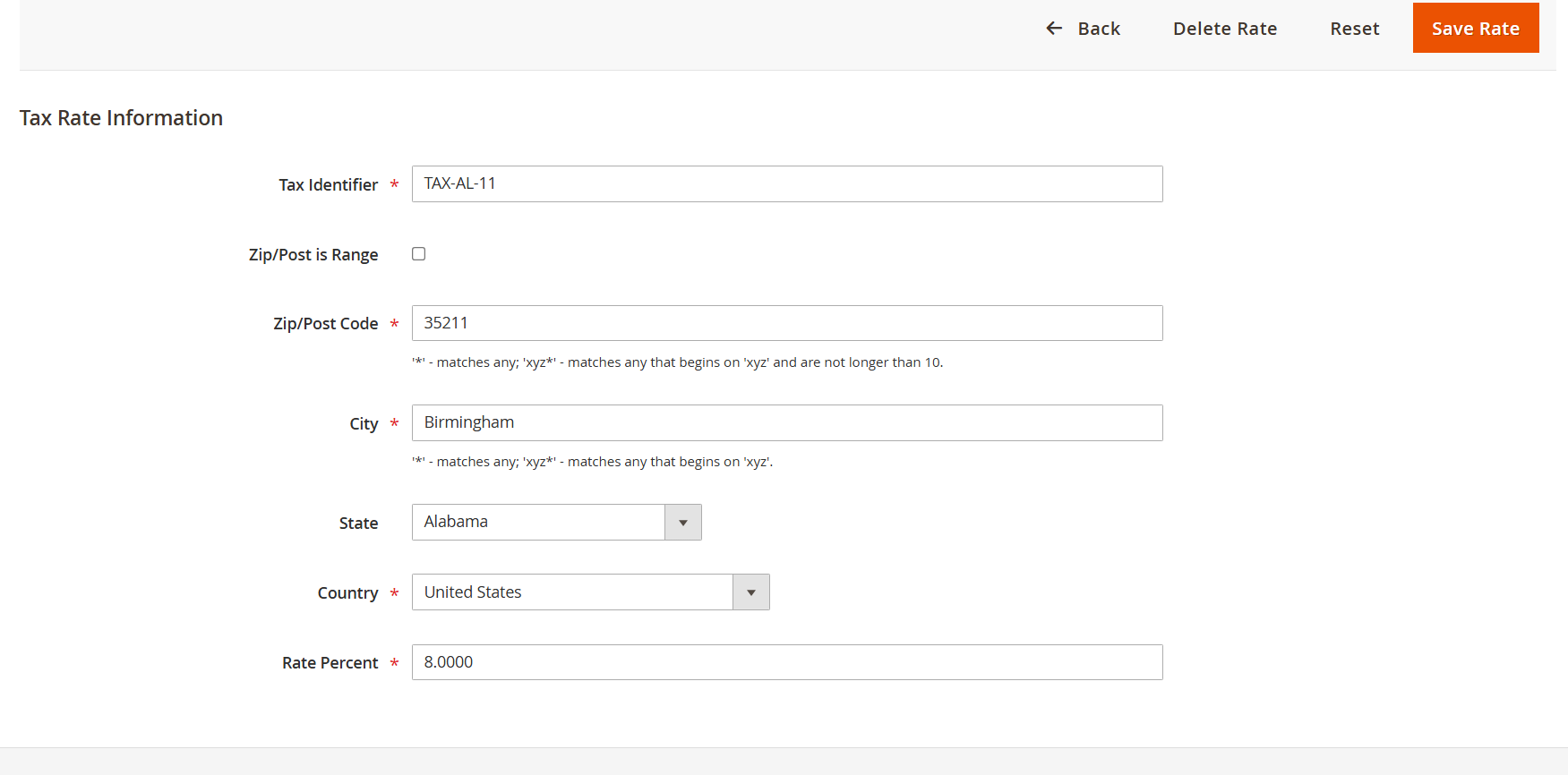

- Manage taxes based on City, State, Country & ZIP code.

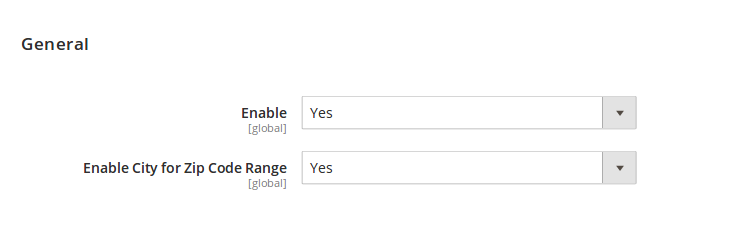

- Enable/Disable the tax by city at any time from the Magento backend.

- Ability to provide ZIP code in ranges. Ex: 56001 - 56005.

- City field can be enabled/disabled for the ZIP code range from the Backend Configuration.

- Reduces the pain point of managing taxes for cities with different ZIP codes or ZIP codes with different cities.

- Supports translations.

- Supports Tax rate API integration to manage city fields via API endpoints.

- Follows Magento 2 extensions standards to ensure high quality.